What is Credit Card ?

A credit card is a plastic card, Which is issued by banks and companies that provide financial services. Banks and financial service companies fund you. Through which you can buy goods or services.

You can pay them later also. Banks and financial service companies give credit only up to a limit. The shape of the credit card is of rectangular type. You can carry the credit card comfortably in your pocket. Because it is of very thin type.

Story

James lived with his wife, children and mother. He was leading a happy life. But he had lost his father. Suddenly corona comes. Everything goes awry in James’ life. He doesn’t even get a chance to understand. He loses his job due to the lockdown. Due to which he becomes unemployed.

Due to lack of job, he had to face financial crisis in lockdown. But the problem got worse when his mother became ill. He did not have money to treat them. He got his mother admitted to the nearest hospital. But money was needed for his treatment.

He asked his relatives, friends and neighbors to borrow money. But everyone refused. No one was ready to lend him money. But he had a plastic card with him. Due to which the bank gives you a loan without interest for a sufficient time.

You have to return that money after a time. Thus he took a loan from the bank through that card and got his mother treated. So that his mother was able to recover from the disease. Let’s know about this plastic card.

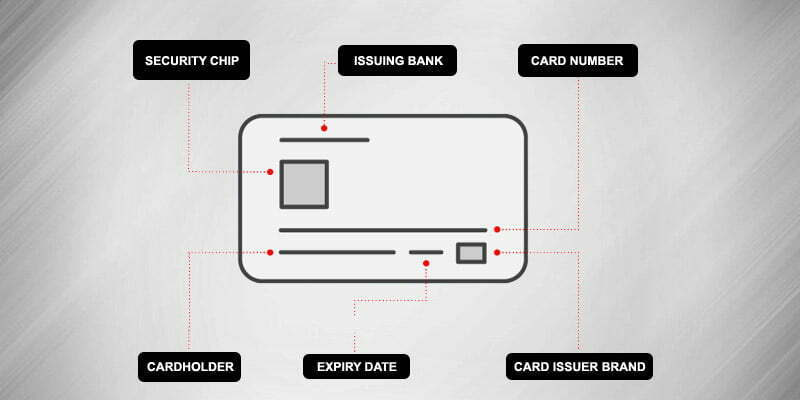

Credit Card Structure

The credit card has a microchip. Which stores your data. This chip also ensures the security of the data. Because the chip keeps the information encrypted. It also ensures the payment security of the credit card.

There is also an account number on the credit card. Which ranges from 8 to 10 digits. This account number is part of the credit card number. It mixes in the number of the credit card itself. In any credit card, it is on the right hand side. Whereas in some it is also on the left hand.

There is also a bank identification number on the credit card. Which ranges from 3 to 6 digits. These are the initial 3 to 6 digit numbers. These numbers are provided by the bank. Because it identifies the institution.

Along with this, credit cards also have an expiration date. Which is in 2 digit format. Month and year are written in it. After that date you have to renew your credit card.

The cardholder name is also on the credit card. Who is the owner of that card. His name is printed on the front of the card. That person is authorized to use the card. Because that person has got permission from the bank. There is also a brand mark on the credit card. Major payment networks are American Express, Visa, MasterCard etc.

Credit Card Limit

You cannot take a loan according to your mind with a credit card. Because it is not practically possible. Credit cards have a credit limit. Which is based on credit score, credit history, income or salary.

You get a credit score in a credit card by looking at your past track record. The credit score ranges from 300 to 900. If your credit score is from 300 to 550. So your credit score is poor.

If your credit score is from 550 to 650. So your credit score is average. If your credit score is from 650 to 750 then your credit score is good. If your credit score falls between 750 to 900, then your credit score is excellent.

Benefits of Credit Card

The biggest advantage of credit card is that the payment in credit card is very less risky. In this you can also make immediate payment. Along with this, the credit card also gives you rewards. For example, you get cashback, like you get discounts on insurance and hotel room booking etc.

The biggest advantage of a credit card is that it is very less risky. In this, you get credit without interest for 1 month. Cashless transactions are done through credit cards.

So that you do not need to carry cash. Credit card is not linked with bank account like debit card is. Just one thing you have to keep in mind that you do not share your credit card information with anyone.

Credit card is the best option for those people who do jobs. Because he can buy any goods and pay them later. When he gets his salary. But they should take care that they do not spend too much, otherwise they can get caught in the debt trap.

If you will build your credit history well, such as making payments on time. So your credit limit keeps increasing. In credit card you get 100% protection from fraud.

How Banks Make Money Through Credit Card

But the biggest question is that banks give you credit without interest for 1 month. Then how do banks make money? So banks charge you an annual fee to earn money, at 1% rate.

If you have not returned the loan within 1 month, then they will also charge late payment charges from you. Banks charge high interest if the credit card bills are not paid on time.

If we talk about credit card history, then Edward Bellamy is considered to be the father of credit card. He used the first credit card in 1887. In which the borrowed money was later paid with interest.

There are two types of credit cards, consumer credit cards and business Credit Cards. Most credit cards are made of plastic. But some credit cards are also of metals.

According to the Federal Reserve’s 2020 report, 80 percent of adults in the US have at least one credit card. According to the American Bankers Association, there are 365 million open credit card accounts in the USA as of 2020.